Contemporary Amperex Technology Co., Limited is a top battery maker for electric cars and energy storage. It is listed on the Shenzhen Stock Exchange, keeping its publicly traded status.

Investors can find this key CATL stock with the ticker SZSE 300750. The company’s market value is over 1.7 trillion CNY. This shows its strong financial position and leadership in the industry.

The company focuses on making advanced lithium-ion batteries for car makers worldwide. It also offers energy storage systems and battery materials globally.

This overview prepares us for a detailed look at the company’s market standing, financials, and investment appeal. We will explore these topics further in our detailed review.

Understanding Contemporary Amperex Technology (CATL)

CATL has grown from a small spin-off to a global leader in clean energy. It leads in battery innovation, working with top car makers worldwide. The company is expanding its reach across many continents.

Company Background and Global Presence

Contemporary Amperex Technology started in 2011 as a spin-off from Amperex Technology Limited (ATL). It focused on electric vehicle batteries. Its base is in Ningde, China, where it developed advanced lithium-ion battery technologies.

CATL has grown fast, opening 13 factories across three continents. It has big operations in Europe, in Germany and Hungary. This helps it serve clients locally, cut costs, and reduce carbon footprint.

The company’s European sites are key to its growth. They help it meet the region’s rising demand for electric cars. They also help CATL deal with trade issues and attract international investors.

Core Business and Product Offerings

CATL focuses on making advanced battery systems for different uses. It offers products for three main areas in the energy storage field.

The electric vehicle division is CATL’s biggest part. It makes battery cells, modules, and packs for cars. These batteries power vehicles from top brands, making CATL a key player in the electric vehicle battery market.

Energy storage systems (ESS) are another big area for CATL. They help stabilise the grid, integrate renewables, and manage commercial power. These systems tackle the ups and downs of solar and wind power.

CATL also offers battery recycling services. This recovers materials from old batteries for new products. It’s a green move that also secures the supply chain.

CATL works with the biggest names in cars. It’s a major Tesla supplier and also works with BMW, Ford, and Volkswagen. These partnerships show the trust these companies have in CATL’s tech and quality.

| Product Category | Primary Applications | Key Technologies | Major Clients |

|---|---|---|---|

| EV Batteries | Automotive propulsion systems | Lithium-ion, LFP chemistry | Tesla, BMW, Volkswagen |

| Energy Storage Systems | Grid stabilisation, renewable integration | Containerised solutions, smart management | Utility companies, commercial clients |

| Battery Recycling | Material recovery, circular economy | Hydrometallurgical processes | Automotive partners, recycling networks |

CATL’s full approach to battery tech, from start to recycling, sets it apart. Its model ensures quality and value across the battery’s life. This makes it a leader in the field.

Is Contemporary Amperex Technology Publicly Traded?

Investors looking into the electric vehicle market need to know about CATL’s trading status. The company allows direct investment through certain channels. But, international investors have unique challenges to face.

Stock Exchange Listing Details

Contemporary Amperex Technology is listed on the Shenzhen Stock Exchange under SZSE 300750. It went public in June 2018, a big step for the company.

CATL’s shares are on the Shenzhen Stock Exchange’s Growth Enterprise Market. This market is for innovative and growing companies. It makes it easy for Chinese investors to buy into a leading battery maker.

The SZSE 300750 listing lets investors see how CATL is doing. They can use market indices and financial platforms that track Chinese A-shares. Trading hours are set by the Shenzhen exchange, and CATL’s big size means good liquidity.

Accessibility for International Investors

US investors have some hurdles when investing in CATL directly. CATL doesn’t have an American Depositary Receipt (ADR) program. This makes investing in Chinese companies harder.

But, there are ways for international investors to get into CATL. Many global brokerage platforms offer access to the Shenzhen Stock Exchange. Interactive Brokers, for example, lets qualified international investors trade Chinese A-shares directly.

For those who want to invest indirectly, ETFs are a good choice. The Amplify Lithium & Battery Technology ETF (BATT) and KraneShares Electric Vehicles & Future Mobility ETF (KARS) both have big CATL holdings. They trade on US exchanges, making foreign investment easier.

Thinking about how to invest in CATL? Investors should think about foreign exchange risks, Chinese market rules, and what they need to do to invest. Each way to invest has its own level of risk and complexity.

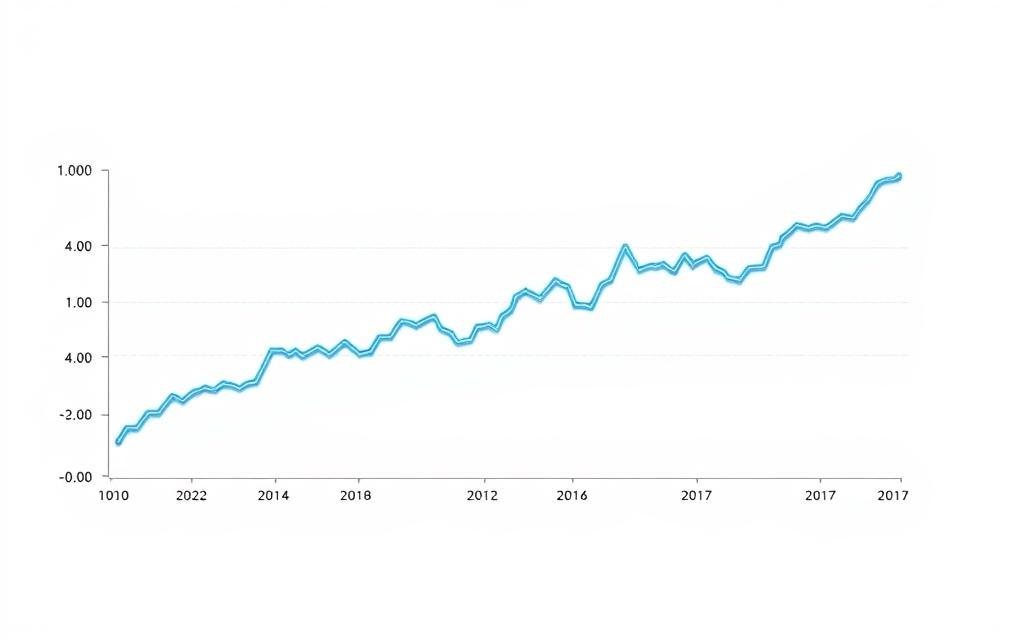

CATL’s Financial Performance and Market Capitalisation

Contemporary Amperex Technology shows strong financial health. This makes it a leader in the battery market. Its financial numbers show it’s a big player globally.

Key Financial Metrics and Analyses

CATL’s market value is about 1.726 trillion CNY. This shows investors believe in its future. It’s a big deal in the energy storage world.

The price-to-earnings ratio is 28.18. This means people think CATL will do well in the future. They’re willing to pay more for its shares.

Earnings per share are 13.29 CNY over the last year. This shows CATL is making good money. In Q2 FY25, it made 94.18 billion CNY. This shows it’s doing well every quarter.

Analysts mostly say buy or strong buy for CATL. They think its shares could go up to 424.57 in a year. This is good news for investors.

Comparison with Industry Peers

CATL beats many rivals in important areas. It has a bigger market share than BYD and LG Energy Solution.

It has:

- More money for research and development

- A bigger patent portfolio

- More manufacturing capacity

- Stronger ties with big car makers

CATL also has better profit margins than most. It’s always innovating and staying ahead of the game.

It’s growing faster than the rest of the industry. CATL is expanding globally and doing it well.

Analysts say CATL’s finances are stronger than others. Its balance sheet helps it stay strong even when markets change.

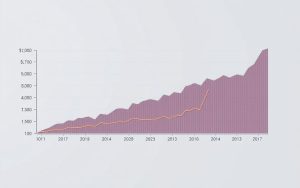

CATL’s Dominance in the Electric Vehicle Battery Market

Contemporary Amperex Technology is the top name in electric vehicle batteries. It holds a 38% market share by 2025. This shows CATL’s lead in tech and partnerships.

Major Clients and Partnerships

CATL works with big names in the car world. It’s a key Tesla supplier, powering many Tesla models. This partnership has helped both grow in electric cars.

The BMW partnership is another key deal for CATL. It’s more than just supplying batteries. They work together on new projects and plan for the future.

Other big car companies also partner with CATL:

- Ford Motor Company

- Volkswagen Group

- Stellantis (through joint ventures)

- Several Chinese car makers

This shows CATL can work with many car makers worldwide.

Innovations and Technological Advancements

CATL stays ahead by always innovating. Its R&D has led to many new technologies.

The Shenxing LFP battery is a big step in charging tech. It can charge a car from 0% to 80% in ten minutes. This fast charging is a big plus for EVs.

CATL also leads in sodium-ion battery tech. This tech has many benefits:

- Less need for lithium

- Better in cold weather

- Cheaper to make

- Safer

The Tener energy storage system shows CATL’s focus on green energy. It helps keep the grid stable and supports renewable energy.

CATL is also making factories that don’t harm the environment. These use clean energy and recycle materials well.

“Our tech isn’t just about better batteries. It’s about green energy for the future.”

These steps keep CATL leading in the electric vehicle battery market. They keep improving while keeping costs down.

Risks and Challenges for CATL Investors

CATL’s market position looks strong, but investors need to think about big challenges. These include geopolitical factors and industry dynamics that could change future returns.

Regulatory and Geopolitical Considerations

CATL faces big regulatory challenges in international markets, mainly due to US-China relations. Being on the US Department of Defense’s list of “Chinese military companies” could limit American investors and partners.

Geopolitical tensions between China and Western countries are a worry. Trade policies and sanctions might block CATL’s growth plans or harm its partnerships with global car makers. These issues are real risks for investors looking to invest internationally.

Environmental rules changing in different markets also pose challenges. CATL must keep updating its manufacturing and product designs to meet new battery recycling and sustainability standards.

Competitive Pressures and Market Saturation

The electric vehicle battery market is very competitive. Companies like BYD and LG Energy Solution are always coming up with new tech and winning big contracts with car makers.

Market saturation is a growing worry as more companies start making batteries. Even though EVs are becoming more popular, the number of suppliers has grown a lot. This could hurt prices and profits.

Supply chain issues are another problem. CATL depends on raw materials from many countries. This makes it vulnerable to price changes and supply disruptions.

New battery technologies could also be a threat. If CATL can’t keep up with new tech, it might lose its lead in the market.

Investment Outlook for CATL Stock

Investors looking at CATL stock have a lot to consider. The company is growing fast and has a strong market position. This makes it a good choice for those interested in clean energy.

Growth Projections and Expansion Plans

CATL is expanding globally to stay ahead. It’s opening big factories in Hungary and Spain. This move will help it serve big car makers better.

It’s also going into Indonesia to use the country’s nickel. Nickel is key for making batteries. This move will help CATL as more cars go electric.

CATL is listing on the Hong Kong Stock Exchange to raise $5 billion. This money will go towards:

- Researching new battery tech

- Building more factories

- Improving supply chains

CATL’s future looks bright because of more electric cars and energy storage needs. It’s working on new battery types. This keeps it at the top of battery tech.

Analyst Ratings and Price Targets

Analysts are mostly positive about CATL’s stock. They believe in the company’s plans and its place in the market.

They think the stock could go up to 424.57 CNY in a year. This is based on CATL’s:

- Revenue growth

- Market share

- Technological progress

- Global growth

Most analyst ratings are “buy” or “outperform”. Only a few say sell. This shows CATL’s strong market position and its role in electric cars.

Analysts like CATL’s partnerships and its work on battery tech. These points make them optimistic about the stock’s future.

How to Invest in CATL from the United States

American investors looking to invest in Contemporary Amperex Technology have several options. They can invest despite CATL being listed in Shenzhen. It’s important to understand the different ways to invest and the things to consider.

Brokerage Accounts and Trading Platforms

US investors can directly invest in CATL shares through international trading platforms. Interactive Brokers is a popular choice. It gives direct access to the Shenzhen Stock Exchange where CATL trades under 300750.

To open an international trading account, you need to provide more documents than for domestic accounts. Check the platform’s fees for foreign trades and any currency conversion costs.

Investors can also use exchange-traded funds (ETFs) for indirect CATL exposure. The Global X Battery Tech ETF (BATT) and KraneShares Electric Vehicles & Future Mobility ETF (KARS) hold CATL.

For a broader China investment, ETFs like the iShares MSCI China ETF (MCHI) are good. They diversify across Chinese sectors and include CATL. This spreads risk while keeping exposure to CATL’s performance.

Tax Implications and Currency Risks

US investors holding foreign securities face specific tax rules. The IRS requires reporting of foreign holdings over certain amounts. This is usually done through Form 8938 attached to your tax return.

Dividends from Chinese companies may have withholding taxes. But, many US-China tax treaties offer relief. It’s wise to consult a tax expert for international investments to ensure compliance and optimisation.

Currency exchange risks are another big consideration. Even if CATL’s stock price goes up in local currency, bad exchange rates can reduce or wipe out gains when converted to dollars.

Some platforms offer hedging options to reduce currency risks. But, these come with extra costs. Investors should consider these costs against the risk of currency volatility when planning their international portfolio.

It’s key for US investors to watch both CATL’s performance and CNY/USD exchange rates. Many track both to evaluate their investment’s success.

Conclusion

Contemporary Amperex Technology is a big deal in electric vehicle batteries. It’s listed on the Shenzhen Stock Exchange. This means investors can get into the growing clean energy market directly.

The investment outlook for CATL looks good. The company leads in technology and is making more global deals. It’s financially strong and keeps innovating, staying ahead in the industry.

Investing in CATL is possible, even if you’re not in China. You can use special brokerages or funds that hold CATL shares.

But, investors need to think about risks too. There are regulatory hurdles and competition to watch out for. The changing world and market fullness are also factors to consider.

CATL stock is worth looking at for those interested in the energy shift. Weighing the good and bad will help investors make smart choices in this fast-changing field.